By Karen Daugherty

If your participants are defaulting on their 401(k) loans, they aren’t “financially well”

On July 31, we worked with Employee Benefits News on an educational webcast, “Is Your Loan Program Getting in the Way of Financial Wellness?” There’s a very strong link between plan loans and financial wellness. If participants default on their 401(k) loans, there are short- and long-term financial repercussions. In the short-term, they get hit with costly taxes and penalties at tax time. In the long-term, they lose $300K on average of retirement security, according to Deloitte.

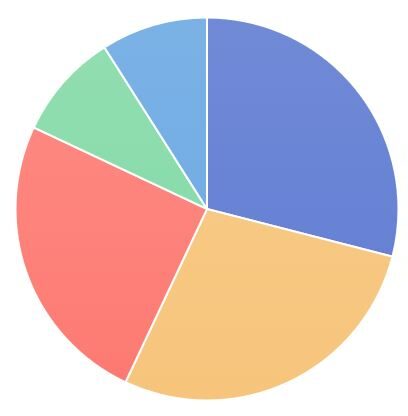

During the webcast, we polled over 100 plan sponsors on how they’re measuring the ROI on their financial wellness programs. The results align with the structure of Retirement Loan Eraser (RLE), which produces instant and measurable results by eliminating loan defaults. The top current measure plan sponsors use is participation, so an automated program that all loan-takers use seems to make a lot of sense. Also, interestingly, 25% aren’t measuring their financial wellness programs at all.

We believe that financial wellness program ROI needs to be measurable. After all, if you can’t measure it, you can’t manage it. One of RLE’s differentiators is that the value is easily quantifiable: preserved financial wellness—measured in dollars—through preventing defaults on 401(k) loans. If you missed the webcast, you can access the recording here.