Home » Thought leadership

Thought leadership

Balancing the Now with the Next

Worker finances are stretched. The majority of employees worry about their ability to save for retirement and meet a financial emergency. Employers want to help. But how? Balancing the Now with the Next explores the factors employers should consider as they think about how to help employees improve their finances – from exploring new types of savings accounts to using existing retirement savings plans in new ways.

3.28 Million and Counting…

A large spike in unemployment leads to an increase in withdrawals from retirement savings. Sponsors should take action now to preserve retirement security.

What Are the True Costs of 401(k) Loan Defaults After a Big Lay-off?

When large companies announce layoffs, what is often missed in the news is the true cost of 401k loan defaults by those employees affected.

Who’ll Stop The Rain?

Over the past two years, plan sponsor and defined contribution industry focus on leakage of participant assets out of the qualified plan environment has increased dramatically

Even in a Boom, Many Are at Risk of Going Bust on 401(k) Loans

The U.S. may have just reached the longest economic expansion on record, but the news underneath the headline numbers is not all about growth.

Up or Down: Where is 401(k) Leakage Really Heading?

This year, we’ve seen some evidence that, after a period of uptick during and after the financial crisis, loan activity in 401(k) plans has subsided slightly in what has been a very strong economy. Just last week, Fidelity reported that 20.1% of participants have loans outstanding, down from a peak of 22.6% in 2013. Earlier this year, T. Rowe Price reported that 22.5% of participants have loans outstanding.

An Unrecognized Link to Financial Wellness

On July 31, we worked with Employee Benefits News on an educational webcast, “Is Your Loan Program Getting in the Way of Financial Wellness?” There’s a very strong link between plan loans and financial wellness.

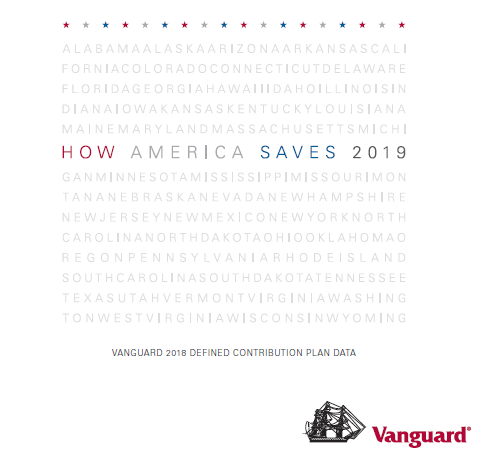

Extended 401(k) Loan Repayment Isn’t Stopping Loan Leakage

In their latest “How America Saves” report, Vanguard highlights that only 4% of participants terminating with an outstanding loan are using ACH repayment. Some in the industry are citing extended repayment as a way to prevent loan defaults—but this minimal uptake suggests limited impact.

Do you know what % of employers feel they would benefit from a financially secure workforce?

Increase Your Plan Leakage IQ Do you know what % of employers feel they would benefit from a financially secure workforce?

Do you know what % of 401(k) plan sponsors want to reduce their plan risk and potential fiduciary exposure?

If you are concerned about plan risk, you are not alone. According to Deloitte’s Annual DC Benchmarking Survey, what % of plan sponsors are concerned