By Aaron Tabela

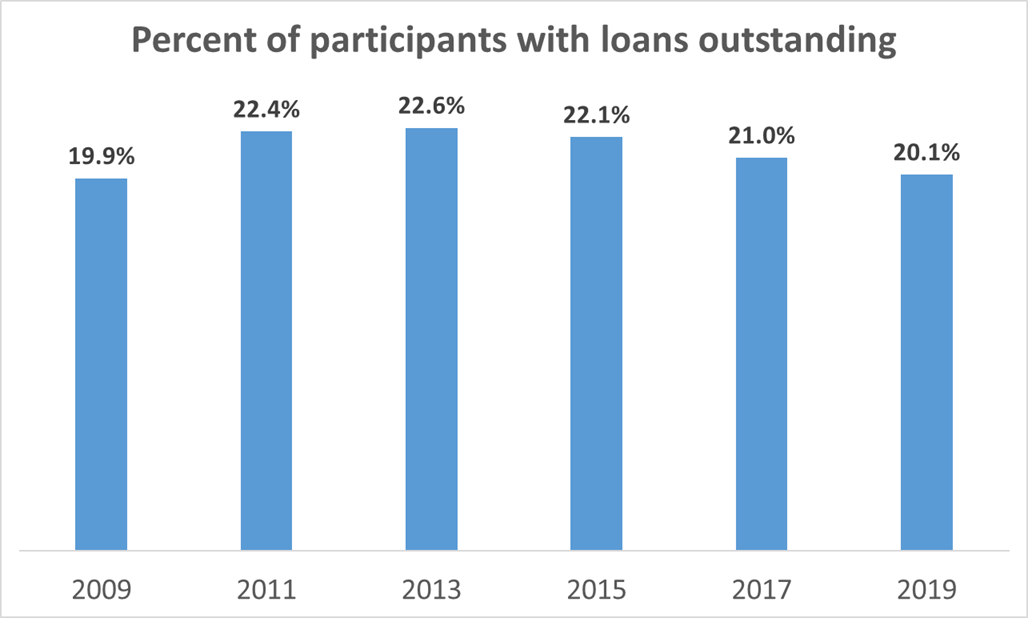

This year, we’ve seen some evidence that, after a period of uptick during and after the financial crisis, loan activity in 401(k) plans has subsided slightly in what has been a very strong economy. Just last week, Fidelity reported that 20.1% of participants have loans outstanding, down from a peak of 22.6% in 2013. Earlier this year, T. Rowe Price reported that 22.5% of participants have loans outstanding.

Wherever things may be headed, more than one in five participants is still a lot. Also, interestingly, it’s roughly the same statistic that the Pension Research Council used in “Borrowing from the Future,” its ground-breaking 2014 study on 401(k) loan leakage, which revealed that, over a five-year period, as many as 40% of participants take a loan, and that nearly 9 in 10 participants who lose their job with a loan outstanding will default. The reality is that employees continue to be financially stressed—hence the continued employer focus on financial wellness programs—and a large proportion will continue to borrow from their 401(k) to fight financial fires that arise.

The Lesser of Two Evils

Some experts in the industry have suggested that any reduction in loan-taking may in part be due to an increase in hardship withdrawals, with this year’s change to allow participants to withdraw not just their own contributions, but also their employers’. If this hypothesis is true, this dynamic is a step in the wrong direction for leakage. While many loan-takers default, at least there’s a good chance that the loan will be repaid. With hardship withdrawals, the leakage is permanent. If this is what happens when you loosen the hardship rules, imagine if we eliminated the loan feature entirely.

The Road Ahead

Looking ahead, the outlook for the U.S. economy is increasingly uncertain, which is why the Federal Reserve cut its benchmark interest rate by 25 basis points at its July meeting. If we are entering a period of economic stagnation—and there even has been discussion among many economists of the dreaded “R-word”—we could see not just an increase in loan-taking, but also an increase in loan defaults, as employers eliminate the jobs of individuals with outstanding loans. Employers should hope for the best, but plan for the worst. That planning should include reviewing loan and hardship withdrawal activity on a regular basis, and taking appropriate action as a fiduciary to mitigate the harm that loan defaults, and leakage generally, do to retirement readiness.